Many Directors use a combination of salary and dividends to pay themselves throughout the tax year to utilise the tax allowances and thresholds in the most efficient way.

Personal Income tax

As Director of a limited company, you must submit an annual self-assessment tax return to HMRC. This return is completely separate from the limited company filings, as it declares what you’ve earned as an individual.

Your self-assessment will declare the income you’ve received from all sources in the tax year, 6th April – 5th April. This might include income from your company, interest payments, income from a rental property, and income from a separate job even if tax has already been deducted.

Following the end of the tax year, the return is due for submission and payment by the end of the following January.

If you owe more than £1,000 in income tax you must make an advanced payment towards next year’s tax bill. The advanced payment is split into 2 equal installments, due in January and July. When we prepare your return we’ll calculate this for you, and let you know how much is owed, and when the payment is due.

If you owe less than £1,000 in income tax, it’s just one payment due by the end of January.

What is a dividend?

Dividends are payments made to company shareholders, based on the percentage of shares they hold, from the profits of the company after Corporation Tax has been paid.

A dividend can only be distributed if the company has made a profit. Profit is the money the company has remaining after paying all business expenses, liabilities, and outstanding taxes.

It is important to note that dividends cannot be counted as a business expense when calculating your Corporation Tax and that it is illegal to pay a dividend if the company has insufficient profits to do so.

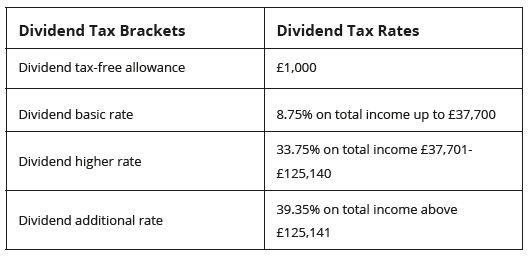

The income tax rates applied to dividends differ from those applied to salary payments. The first £1,000 of dividends received in the 2023/24 tax year are taxed at 0%. Therefore, if your profits and cashflow allow, you should always take £1,000 of dividends as to utilise the tax-free dividends allowance.

Although dividends can be taken at any time in the year, you need to ensure that there is sufficient cash left in the business to cover any taxes not yet due such as VAT or Corporation Tax.

If you are unsure of your company’s profit levels and upcoming tax liabilities, please get in touch with your accountant.

Taking a salary

As a director, you can choose to take a salary from your Limited company. Deciding the appropriate level to run your salary at is important for tax planning purposes.

In order to take a director’s salary your company must be registered for PAYE (Pay As You Earn). Any salaries run will be classed as an allowable business expense, meaning it will lower your Corporation Tax liability.

As a UK taxpayer, in the 2023/24 tax year, most individuals will be entitled to a tax-free allowance of £12,570, known as a personal allowance. There is also a National Insurance Contribution (NIC) threshold for both employees’ and employer’s contributions, which for employees is set at the same rate as the personal allowance. However, the employer’s National Insurance Contribution threshold (secondary threshold) is set at a slightly lower amount.

For directors with no other earnings in the tax year, we would recommend running a salary at the personal allowance, which is £1,047.50 per month. At this rate you would have no Income Tax or employees National Insurance to pay, however, you’ll still accrue qualifying years for the state pension.

Please be aware that running a salary at this rate will incur a small number of employer’s National Insurance which will be payable to HMRC. However, this is still deemed to be the most tax-efficient salary rate for a sole director with no other earnings.

There are various factors to consider when determining the appropriate split between salary and dividends, therefore please speak to your accountant to understand the tax impact from an individual and company perspective.

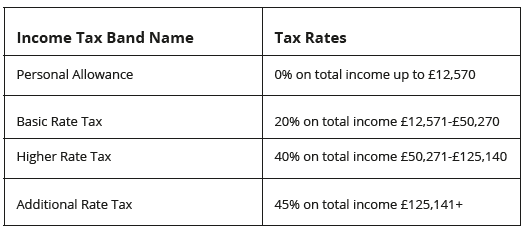

Income tax and dividend tax rates for 2022-2023

These tables explain the different tax rates for income tax and dividends. When your self-assessment tax return is prepared, we’ll look at your total income and calculate the relevant tax depending on the type of income you’ve received.

Before we can make any payroll (PAYE) filings for you, we need to have HMRC authorisation. Applying for this can take weeks so please let us know as soon as are thinking about taking a salary or hiring a member of staff.

We charge additional fees to process payroll and file pension contributions. If this isn’t already included in your package, the team would be happy to provide a quote.